- Project accounting: Principles to follow

- 1. Detailed visibility of everyday expenditure

- 2. Accurate and realistic project budgets

- 3. Real-time financial reporting

- 4. Better control over cost and project billing and reduced failure risk

- Step 1: Define project accounting needs and select your project accounting software

- Step 2: Set up a functional project accounting plan

- Step 3: Establish project costs with careful estimations

- Step 4: Define revenue

- Step 5: Set up real-time expense and time-tracking

- Step 6: Generate regular project reports

- Step 7: Identify potential issues and take corrective action

- Maintain a Schedule of Values (SOV)

- Review meeting minutes and progress reports

- Prefer evidence-based cost reports

- Be vigilant about change orders

- Always review labor hours and subcontractor bills

- Revisit the project schedule at regular intervals

Summarize this article with AI ClickUp Brain not only saves you precious time by instantly summarizing articles, it also leverages AI to connect your tasks, docs, people, and more, streamlining your workflow like never before. Summarize article

Summarize this article for me pleaseWhat Is Project Accounting?

You may be familiar with general financial accounting, but project accounting is a different beast. In simple terms, it’s about tracking project financials at any scale to measure the profitability of a job. You get to track cost centers and profits for individual projects in your company. Unlike general accounting, which provides an overview of a company’s overall financial position, project accounting drills into the specifics of each project’s financial health. Its microscopic overview lets you see the intricate details that might otherwise be lost in the broader landscape of your financial statements. 🔬 As a business owner, you’re always looking for methods to increase project profitability, and project accounting enables just that. By keeping track of each project’s expenditures and income, you determine which initiatives are the most lucrative and which should be reviewed, refined, or even abandoned. Plus, with a granular understanding of how money is spent and earned on each project, you anticipate potential cash flow issues faster, plan resource management more effectively, and make informed decisions about future projects. Bonus Tip: You can now use ClickUp to manage Project Finances to get full insights into the profitability of your ventures. From tracking your project budget to managing payment deadlines, handle everything from a single platform. 🤠

Project accounting: Principles to follow

- Use a distinct project accounting system: Segregate accounting systems on a project-by-project basis to get clearer performance metrics. For example, Project A and Project B follow different revenue recognition methods—the former uses the percentage of completion method while the latter calculates profits based on the accrual accounting system. With a separate accounting system for each, you’ll be able to keep track of the costs and revenues of individual projects with precision

- Forecast your budgetbefore starting a project: A predefined budget gives you a financial roadmap to follow, providing benchmarks against which you can measure actual costs and avoid unnecessary surprises

- Identify key performance indicators (KPIs): Financial KPIs let you track progress across projects and flag any potential issues early. Having preset numbers allows any project team to have sharper foresight and practice preemptive problem-solving

- Establish cost codes for your expenses: This principle requires you to acknowledge all potential liabilities in advance, including contract penalties. That way, you can easily manage costs across different areas of your project, ensuring everything’s in line with your expectations

- Make it a habitto run regular financial reports: Consistently keep tabs on your project status and identify any emerging issues. To ensure this principle is followed, most busy managers delegate reporting duties to the project accountant

Summarize this article with AI ClickUp Brain not only saves you precious time by instantly summarizing articles, it also leverages AI to connect your tasks, docs, people, and more, streamlining your workflow like never before. Summarize article

Summarize this article for me pleaseWhy Is Project Accounting Important?

Still considering the reasons for adopting project accounting? Here are four top benefits that become accessible upon implementation.

1. Detailed visibility of everyday expenditure

Project accounting allows tracking both per-day and cumulative project costs for specific hierarchies across departments and cost centers. With a real-time financial radar for every outflow, it’s incredibly simple to make intelligent resource allocation and other managerial decisions and stay one step ahead of possible hurdles.

2. Accurate and realistic project budgets

Project accounting helps identify potential cost savings and allows managers to make on-the-go adjustments to project budgets, ensuring efficient resource management. Budgeted data and comparison with actual figures also help you make more accurate fiscal projections, as well as bid with robust estimates for future projects. And when it comes to pricing your products and services, project accounting is your cheat code to staying competitive and profitable without going overboard on the spending. 💸

3. Real-time financial reporting

You can generate comprehensive financial reports for each project, offering stakeholders—who may not always understand the complexities of project accounting work—a crystal-clear view of project performance. The reports are typically comparative, allowing for tracking fiscal differences and locating savings potential meaningfully. This level of transparency strengthens your professional relationships, particularly with clients, and elevates your reputation as a reliable and trustworthy business entity. It’s a strategic move that goes beyond numbers, demonstrating your commitment to financial integrity. 🌼

4. Better control over cost and project billing and reduced failure risk

Project accounting is your ticket to controlled financial transactions and billing logistics. It steps up to keep you in the loop, always up to date about, say, material orders or payment deadlines. Everything runs like clockwork, and there’s a significantly lower risk of the project getting derailed.

Summarize this article with AI ClickUp Brain not only saves you precious time by instantly summarizing articles, it also leverages AI to connect your tasks, docs, people, and more, streamlining your workflow like never before. Summarize article

Summarize this article for me pleaseHow to Implement a Successful Project-Based Accounting System: 7 Steps

Investing time and resources in project accounting and implementing it meticulously will pay you back multifold. Plus, it’s your guide to figuring out which clients and projects are the real winners or what process inefficiencies are costing you big time. The only problem for most project managers is: Where do I start? We have broken down the standard project accounting cycle into seven steps. Read along, put them to the test, and see firsthand how the right project accounting process flow can transform the way you manage project finances. 🔥

Step 1: Define project accounting needs and select your project accounting software

- Identify project scope: Understand the size, duration, and complexity of the target projects. This will determine the level of detail and diversity required in specific project accounting systems

- Determine measurable financial metrics: Define the key performance indicators you need to track. These could include costs, revenues, margins, or cash flows

- Establish financial reporting needs: Decide how often and in what format you want to receive financial updates, who’s creating reports, and what parties must be notified

- Consider software requirements: Evaluate if you need project accounting software and what features it should have to meet your needs

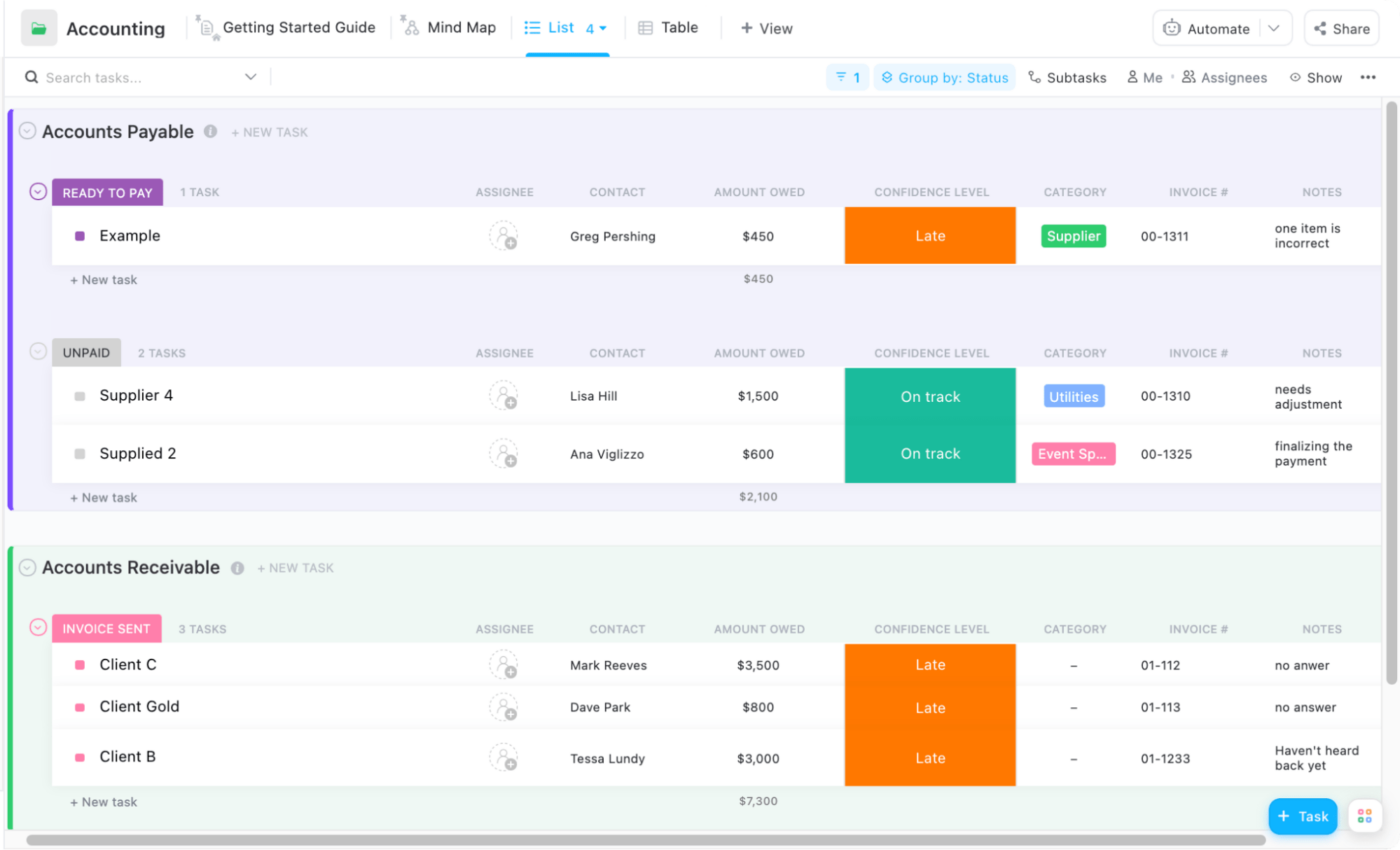

If you’re looking for project management software with built-in features for handling project accounting and auditing tasks, you can consider ClickUp. From setting measurable project Goals to allocating resources within time, people, and budget constraints—it’s a one-stop solution with accounting tools perfect for both new and experienced project managers!

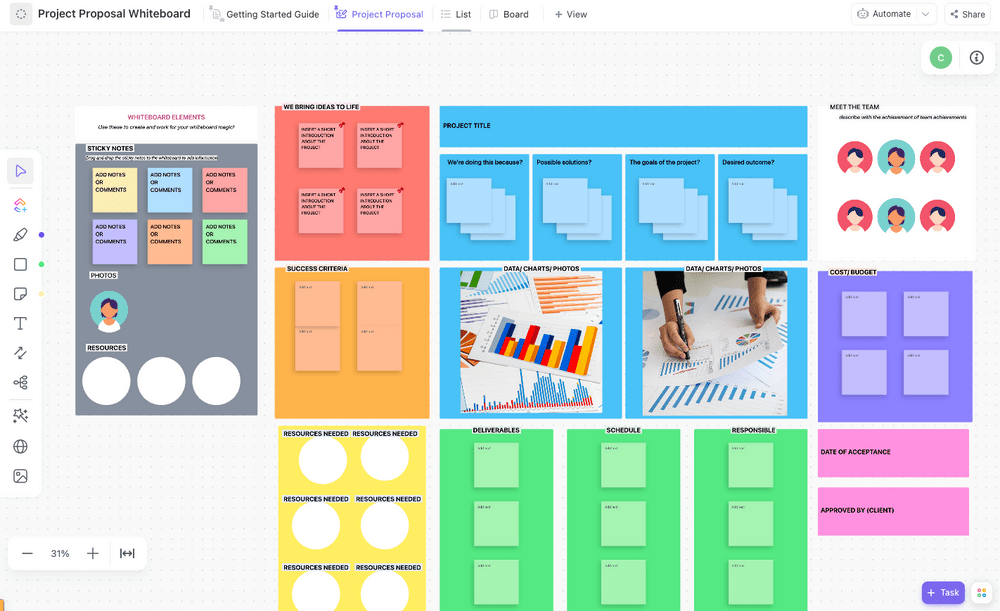

Since this step focuses on creating a project outline, why not start with the ClickUp Accounting Project Proposal Template? This template is your go-to guide for laying out the whats, whens, and hows of a particular project. It helps you spell out exactly what ROI or profit margin you’re aiming to achieve and establish project accounting rules. ✍️

Step 2: Set up a functional project accounting plan

Once you’ve nailed down your project accounting needs, it’s time to prepare a suitable plan that aligns with them. The idea is to align your project accounting systems with your business’s overall financial accounting framework. Answer questions about tax and legal repercussions, fiscal overlaps, and contingency funds.

Start financial planning for projects the right way using the ClickUp Accounting Suite. It comes with 1,000+ templates suitable for accounting and project teams. 😍

For instance, if you want to collaborate with team members on your accounting plan, just jump on the ClickUp Accounting Operations Template. Its ready-made structure can be used to organize and track operations within individual projects, making it easy to centralize your accounting tasks.

Other benefits of ClickUp include:

- Extensive project budgeting, reporting, and tracking features

- Integration with other business systems and apps to ensure smooth data flow and accessible financial information

- An AI work assistant, ClickUp AI—it uses natural language processing to assist with multiple project tasks, such as:

- Summarizing accounting plans

- Writing project briefs, client communication, etc.

- Brainstorming ideas

While investing in good software is vital, it’s got to match your wallet size. Luckily, this project management software is like a pair of stretchy pants—it grows with you! And the best part is that it comes with free, pocket-friendly, and customizable enterprise plans.

Step 3: Establish project costs with careful estimations

Believe it or not, accurate budgeting and cost estimation form the bedrock of efficient project management, ensuring your project stays financially viable and sustainable. Here’s how you can do it:

- Identify all potential overhead costs: Consider all possible cost centers, from resources and labor to contingencies

- Estimate costs: Use historical data, market rates, or expert opinions to quantify these costs

- Prepare the budget: Combine your cost estimates into a comprehensive budget

- Review and revise: Continually monitor and adjust your budget as the project progresses

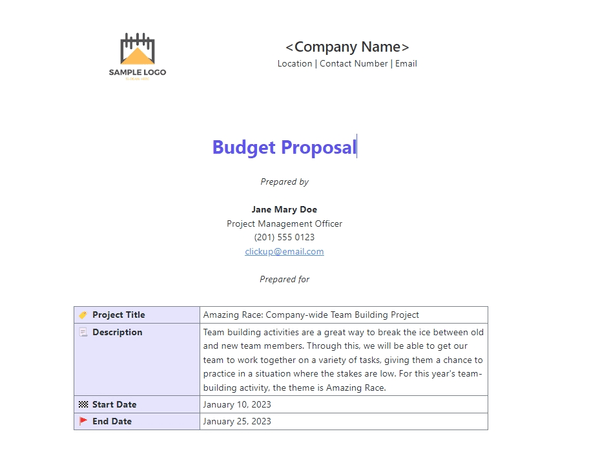

Easier said than done, but we’ve got you covered with the “done’’ part, too. The ClickUp Budget Proposal Template acts like your financial GPS. It breaks down project costs into bite-sized pieces, ensuring you and your stakeholders have a reliable financial roadmap. 🛣️

Step 4: Define revenue

Not all company projects bring in money right away. Some projects, like simplifying a time-card system, don’t even make money directly, but they set the stage for a wider profit margin in the future. On the flip side, projects such as building a house, constructing a road, or creating a new software product can generate revenue that covers their costs within a defined timeline.

When it comes to getting paid for projects, the revenue recognition varies—and your project accounting system must adapt to that. Some projects pay once the work is done, while others follow the cost-to-cost method and register partial payments as the work progresses.

It’s smart to set clear rules on when you get paid and when you actually count that money as revenue—do this before kicking off the project. 💲

You can track the revenue and growth for individual projects with the ClickUp Revenue Growth KPI Tracking Template. Create copies of this template and customize it with unique revenue recognition styles and performance benchmarks.

Step 5: Set up real-time expense and time-tracking

Why should you implement real-time expense and time tracking? Easy: to ensure everything stays on budget and schedule. You will be able to identify any unforeseen expenses or delays as soon as they appear, allowing you to take quick action for project success.

You may want to use ClickUp Project Time Tracking to track labor hours, segregated timesheets, and expenses and get an up-to-the-minute snapshot of project progress. ⏳

For an even quicker way to keep tabs on your expenses, check out the ClickUp Project Cost Management Template. Let’s say you’re handling project cost accounting for a construction venture. This template makes tracking project costs for different things like materials, labor, permits, and equipment effortless. See how your budget holds up in real time and update in the event of price spikes and similar changes.

Step 6: Generate regular project reports

Project accounting is much like management accounting: you must understand what numbers represent and how they impact project success. With native reporting options within ClickUp, it’s easier to get numerical and visual reports for different project parameters, including team resources and budget trails. Use these insights to enhance your project accounting practices, improve efficiency, and increase profitability. 💯

Two additional tips:

- Regularly generate and review these reports to monitor the project’s financial health—do it weekly or monthly depending on the volume of project tasks

- Keep your reporting style flexible—customize reports with relevant metrics that provide insight into project performance

Need a go-to? The ClickUp Project Reporting Template lets a project manager zoom in on those areas needing a bit more love by painting a detailed picture of high-level KPIs and overall performance. It helps you keep tabs on crucial elements like project tasks, expenses, and lingering to-do items.

Step 7: Identify potential issues and take corrective action

Don’t just sit on compiled data; analyze it right away. Use it to identify trends, forecast outcomes, and identify completion risks. Keep an eye out for any potential issues that could derail project finances. These could range from cost overruns and delayed timelines to unanticipated resource allocation needs.

Let’s say some of these scenarios came true. How would you handle them? Well, ClickUp can level up your issue management game with:

- Agile-ScrumDashboards: Get a quick and comprehensive view of your workflow and keep tabs on your team’s progress in handling defects

- ClickUp Sprints: Engineering firms can make bug squashing a breeze with agile sprint planning

- Assign Tasks: With a comprehensive Task Management Suite, there’s no confusion about who’s tackling what

- Roadmaps: Map out the nitty-gritty details of your corrective workflow and easily share them with your project team

- Custom Task Statuses: Create a personalized project accounting process flow by giving Custom Statuses to ongoing issue resolution activities

- ClickUp Gantt Charts: Tackle delays and resource management issues with confidence by prioritizing tasks demanding immediate attention on a flexible timeline 🆘

Be proactive here, as swift corrective action can mitigate any adverse impact on project profitability.

Summarize this article with AI ClickUp Brain not only saves you precious time by instantly summarizing articles, it also leverages AI to connect your tasks, docs, people, and more, streamlining your workflow like never before. Summarize article

Summarize this article for me pleaseBest Practices of Project Accounting

Project accounting best practices revolve around effective project management processes, controls, and procedures when addressing issues. There are some best practices you can follow while making decisions around pricing, bidding, contract processes, and contract provisions. The goal is to improve the development of controls and documentation. Here are some key best practices to follow:

Maintain a Schedule of Values (SOV)

For project accounting within engineering firms, maintain a detailed SOV outlining the cost for different work portions in a completed contract. This enables a transparent percentage of completion calculation.

Review meeting minutes and progress reports

Regularly review meeting minutes and progress reports to detect deviations from the original agreement and alert your accounting team accordingly.

Prefer evidence-based cost reports

Keep a consistent check on project reporting, especially the cost reports, to ensure there are no unsupported financial transactions. Use Request for Information (RFI) documents to address information gaps in plans, contracts, documents, or specifications when necessary.

Be vigilant about change orders

Change orders signaling alterations to the original statement of work can confuse the entire team and lead to project budget disruptions and halted work. Develop a change order plan to allow project managers to tweak every cost center carefully.

Always review labor hours and subcontractor bills

Regularly review labor hour documentation, potentially every week, to align with the project forecast. Verify that all subcontractor bills are for approved charges.

Revisit the project schedule at regular intervals

Recalculate the project schedule regularly, starting from the task level and progressing to the overall project and macro (company-wide) level, ensuring timelines align with expectations.

Summarize this article with AI ClickUp Brain not only saves you precious time by instantly summarizing articles, it also leverages AI to connect your tasks, docs, people, and more, streamlining your workflow like never before. Summarize article